rsu tax rate calculator

How can I reduce tax on RSUs. Most companies will withhold federal income taxes at a flat rate of 22.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Picnics goal is to make tax filing simpler and painless for everyday Americans.

. Salary 150000 rsu value 20000. How Are Restricted Stock Units RSUs Taxed. RSU Taxes Explained.

The current total local sales tax rate in Piscataway NJ is 6625. The ordinary earned income tax rate when the RSUs vest or. Senior citizen who is 60 years or more at any time during the previous year net income range.

Its important to remember that the RSU tax rate will be the same as your income tax rates. Because there is no actual stock issued at grant no Section 83 b election is permitted. An RSU is a grant valued in terms of company stock but company stock is not issued at the time of the grant.

When your RSUs are vested the stock broker will sell some units to withhold taxes and give you the rest. You receive 4000 RSUs that vest at a rate of. RSUs Restricted Stock Units RSUs are the most common way that public companies grant company stock to employees.

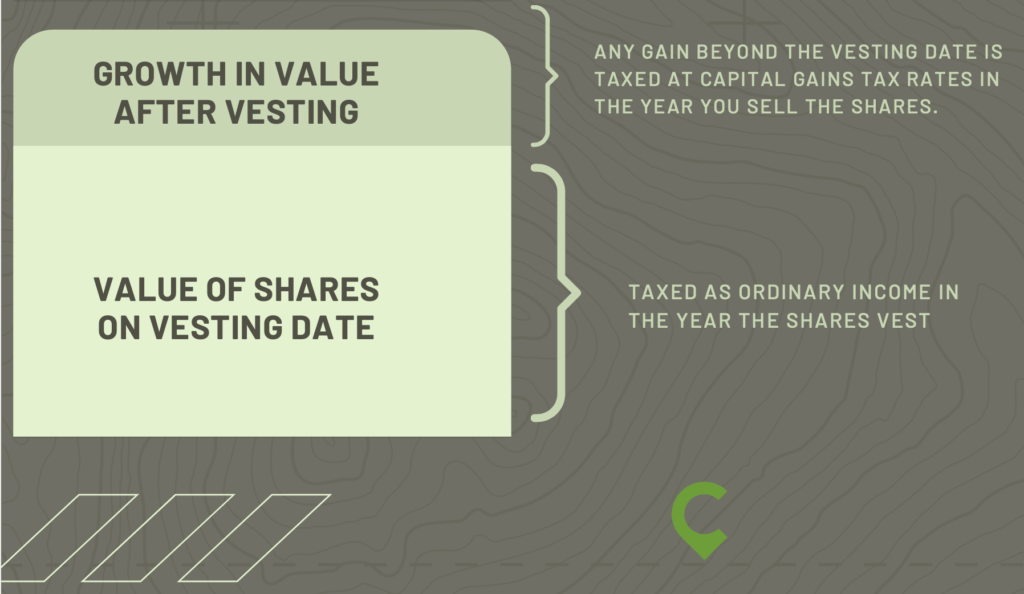

A restricted stock unit RSU is a form of equity compensation used in stock compensation programs. You pay taxes on the value of the RSUs at vesting. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers.

Employeeemployer NIC rates as of tax year 202223. Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. From my experience same day sale sell to cover RSUs are treated as bonus and are withheld at the highest rate.

After the recipient of a unit satisfies the vesting requirement the company distributes shares or the cash equivalent of the number of. Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. Any over payment will be returned to you when you file your tax return.

It is important for you to contact your tax advisor about the impact of these events on your taxes. The withholding rate is what might be different which is a common source of confusion. The capital gains tax rate when you sell the shares you own.

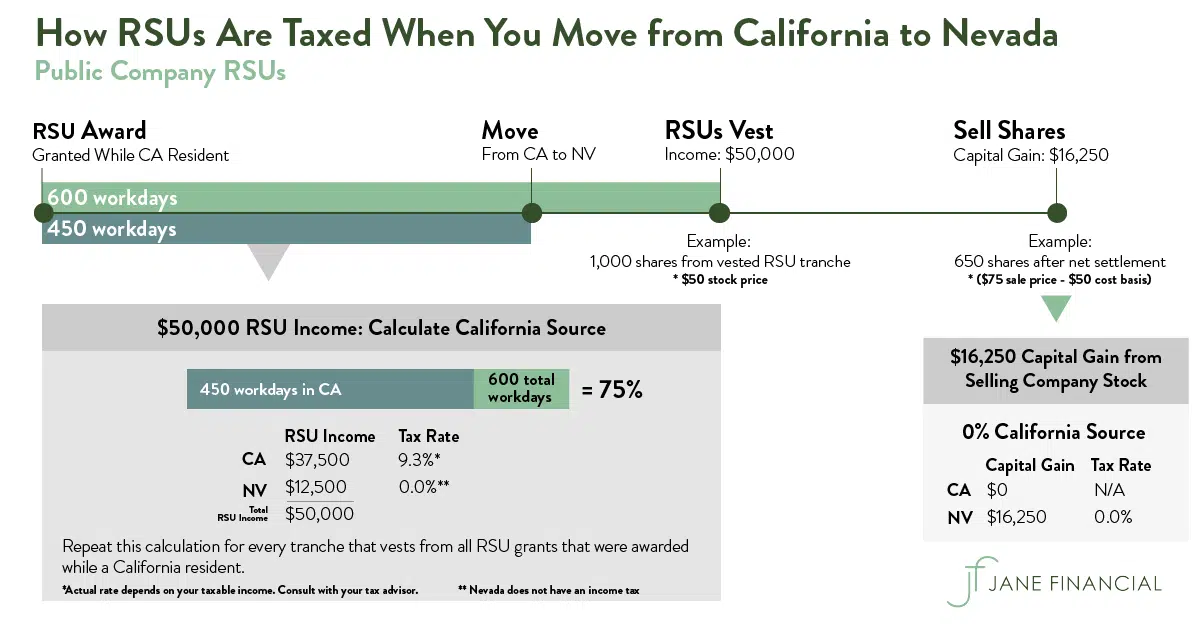

TSB-M-077I Income Tax October 4 2007 - 3 - The New York State Court of Appeals decision in Matter of Michaelsen vNew York State Tax Commission 67 NY. Unlike the much more complicated ESPP they get taxed the same way as your income. This is true whether were talking about.

Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. 2d 579 established that a nonresident individual employed in New York State who received an incentive stock option IRC section 422 exercised the option and. The value of over 1 million will be taxed at 37.

Ryan McInnis founded Picnic Tax after working for more than a decade at some of the financial services industrys leading firms. Estimated Taxes From RSUs Due at Vest - This shows the estimated taxes youll owe from your RSUs vesting. Here is an article on employee stock options.

Restricted Stock Units RSUs Tax Calculator. RSU Tax Rate vs. Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below.

This is because paying into a pension reduces your adjusted net income which in effect reduces your tax bill and potentially your overall tax rate. Its based on your current tax rate and theres a. This is the tax they withhold not necessarily the tax you will owe.

RSU Tax Rate. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. If you want to do tax calculations then it is a bit complicated.

As the name implies RSUs have rules as to when they can be sold. The December 2020 total local sales tax rate was also 6625. The taxation of RSUs is a bit simpler than for standard restricted stock plans.

RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. Its important to remember that the rsu tax rate will be the same as your income tax rates.

RSU Withholding Rate A Common Confusion. RSUs can also be subject to capital. Here is the information you need to know prior to jumping in.

Step 5 - Review Outputs of RSU Tax Calculator. Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean.

Typically the number of years to fully vest all units is 4 yrs. Example Of RSU Life Cycle. If you just want to calculate your TC then sure RSU per unit price number of years the RSU will vest.

Stock grants often carry restrictions as well. RSUs Restricted Stock Units are a big part. The beauty of RSUs is in the simplicity of the way they get taxed.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. The employer will withhold federal and state income tax on RSU income at the mandatory supplemental withholding rates which are different from regular income tax withholding rates. At any rate RSUs are seen as supplemental income.

How your stock grant is delivered to you and whether or not it is vested are the key factors. Taxation of RSUs. The following hypothetical example outlines the entire life cycle of an RSU grant.

Tax Implications of Restricted Stock Units. The value of RSU shares is taxed the same as regular salary or wages with one exception. Once all the assumptions have been entered the RSU tax calculator will provide three outputs and they are all pretty self-explanatory.

One way to reduce how much tax you pay on RSUs is by making pension contributions. The term restricted refers to the vesting schedule or the specified period that must elapse before youre paid the shares of stock.

Stock Option Vs Rsu Top 7 Differences To Learn With Infographics

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Explaining Rsus Or Restricted Stock Units Eqvista

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Equity Compensation 101 Rsus Restricted Stock Units

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Tax Rate Is Exactly The Same As Your Paycheck